The purpose of the Texas Safety Responsibility Law (n/k/a the Motor Vehicle Safety Responsibility Act) is to promote safe driving practices among all owners and operators of motor vehicles using the highways of this State, and to require such owners and operators to discharge their financial responsibility to others for damage to persons or property occasioned by the exercise, by such owner or operator, of the privilege or license of using the public highways of this State. Gonzalez v. Texas Department of Public Safety, 340 S.W.2d 860, 863 (Tex.Civ.App.-El Paso 1960, no writ). Under the Act, the owner/operator of an automobile is required to establish financial responsibility, such as an automobile liability insurance policy, before operating a vehicle on Texas highways.

Texas’ Financial Responsibility law requires you to maintain liability limits of at least: Auto liability of insurance coverage.

$20,000 | Bodily Injury per Person: The first number is the maximum amount that your policy will pay for bodily injury to or death of one (1) person in any one (1) accident, i.e., minimum liability coverage at $20,000 for one person's injuries or death.

$40,000 | Bodily Injury per Accident: The maximum amount that your policy will pay for bodily injury to or death of two (2) or more persons in any one (1) accident, subject to the $30,000 per person limit, i.e., medical coverage at $40,000 for the injury or death of two or more people.

$15,000 | Property Damage: The maximum amount that your policy will pay for injury to or destruction of property of others in an accident, i.e., property coverage at $15,000 for property damage.

How much does it cost for a teenager to have car insurance?

The average annual rate quoted for a teen driver is $2,267. (This average includes all liability coverage levels.) Compare that to an average cost increase of $621 for adding a teen to the parents' policy — that means you'll pay 365 percent more by putting the teen on his or her own policy.

How much is car insurance for a 18 year old?

We sampled quotes for student car insurance across the United States, and found the average to be $5,411 for a single male 18 year old with liability coverage just above the state minimum. Your individual rates may differ based on your background, the car you drive, and the coverage you seek.

How much is car insurance for a 19 year old?

Full-coverage insurance will cost more than a liability-only policy, and insurance with high deductibles will be cheaper than the same policy with a lower deductible. On average, a 19-year-old male will pay anywhere from $1,200 to $2,600 per year. Female drivers will pay slightly less for these same policies.

How much is car insurance for a 25 year old?

A single 25-year old female with one traffic violation and one no-fault accident driving 12,000 miles per year will typically pay $1,364.72. A married couple (both age 50) with a 20-year-old son and 18-year-old daughter will pay an average of $3,027.23 annually for car insurance.

How much does your car insurance go down when you turn 25?

Rate Decrease. On average, you'll find that the auto insurance premium will decrease by up to 20 percent for males when they turn 25. That figure is generally less for females and is usually between 12 percent and 15 percent.

Does car insurance go down at 25?

While people under 25 are statistically more likely to get into an accident, each company handles the impact of age on the price of the policy differently. There is no hard and fast rule that once you turn 25, the price of your car insurance will decrease. Some carriers may offer a pricing break at 21, 23, or 30.

How much does your car insurance go up after an accident?

In general, the study found, drivers who make a single claim of $2,000 or more can expect their premiums to increase by 41 percent. That translates to a $335 increase for the average U.S. auto insurance premium of $815 a year. For the unfortunate souls who make two claims in one year, the increase jumps to 93 percent.

The best way to get cheap car insurance is to compare multiple insurance companies quotes: GEICO, PROGRESSIVE CORPORATION, STATE FARM, ALLSTATE AUTO INSURANCE, FARMERS INSURANCE GROUP, LIBERTY MUTUAL INSURANCE, ESURANCE, AMERICAN NATIONAL, NATIONALWIDE FINANCIAL SERVICES,INC, TRAVELERS, 21ST CENTURY, SAFECO, UNITED AUTOMOBILE, INFINITY AUTO, AUTO-OWNERS, USAA, METLIFE, DIRECT GENERAL, AIS, COVER HOUND, ELEPHANT AUTO INSURANCE

Click here to know more details on Texas Auto Insurance

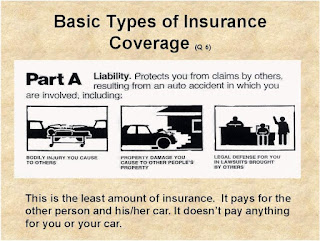

What is liability insurance?

Liability insurance reduces the financial impact of claims filed against you should you become involved in a car accident. An automobile insurance card is the required form of proof. If you do not own a car, when at the DPS office you will be required to sign and swear to a statement that you do not own a vehicle. This exempts you from the Texas vehicle registration and liability requirements. You will still need to provide a vehicle for the driving test.

After residing in Texas at least 30 days you may apply at any Texas DPS license office.

Requirements:

✓ DPS application

✓ Application and exam fees - $36

✓ Proof of identity

✓ Proof of residing in Texas at least 30 days*

✓ Proof of lawful presence

✓ Social Security Number - If you are not eligible for a Social Security Card, you will be asked to sign an affidavit

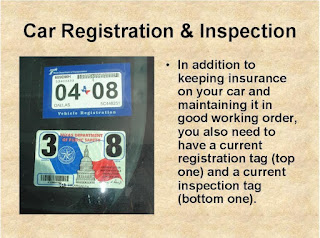

✓ Proof of vehicle registration - vehicle owners only

✓ Proof of sufficient liability insurance - vehicle owners only

✓ Pass the DPS written test

✓ Pass the DPS driving skills test - you provide the vehicle

✓ DPS vision test

* Students with unexpired licenses from other states are exempt from the 30-day requirement.

What will the process be like?

The whole process usually takes more than one visit to the DPS office and wait times can be long.

✓ Upon arrival you will complete an application and present your documents to a clerk.

✓ If your paperwork is in order you will be given a written exam.

✓ Once you pass the written exam you can set an appointment for a driving skills test.

✓ The driving test involves an examiner riding with you as you drive a specified route.

✓ Once you pass both exams you will given a vision test, thumb-printed and photographed.

This is required of all Texas drivers.

✓ A paper driving permit will be given on site which allows you to drive legally until you receive the driver’s license.

✓ The license will be mailed in a few weeks.

✓ Currently DPS is requiring international students to renew licenses annually.

How can I prepare for the written exam and driving test?

The written exam is based on the Texas Driver’s License Handbook. The handbook is free and available online in the Forms section of the DPS website. Sample test questions can be found at the back of the book.

Once you pass the written exam, you can request an Instruction Permit which will allow you to practice driving on public roads when accompanied by a licensed, adult driver. The permit is optional. Professional driving lessons can also be arranged through private driving schools and some public schools.

No comments:

Post a Comment